Flexi has RM200000 According to the EIS contribution table. Basic Allowance Incentive 26 days 8 hours.

Everything You Need To Know About Running Payroll In Malaysia

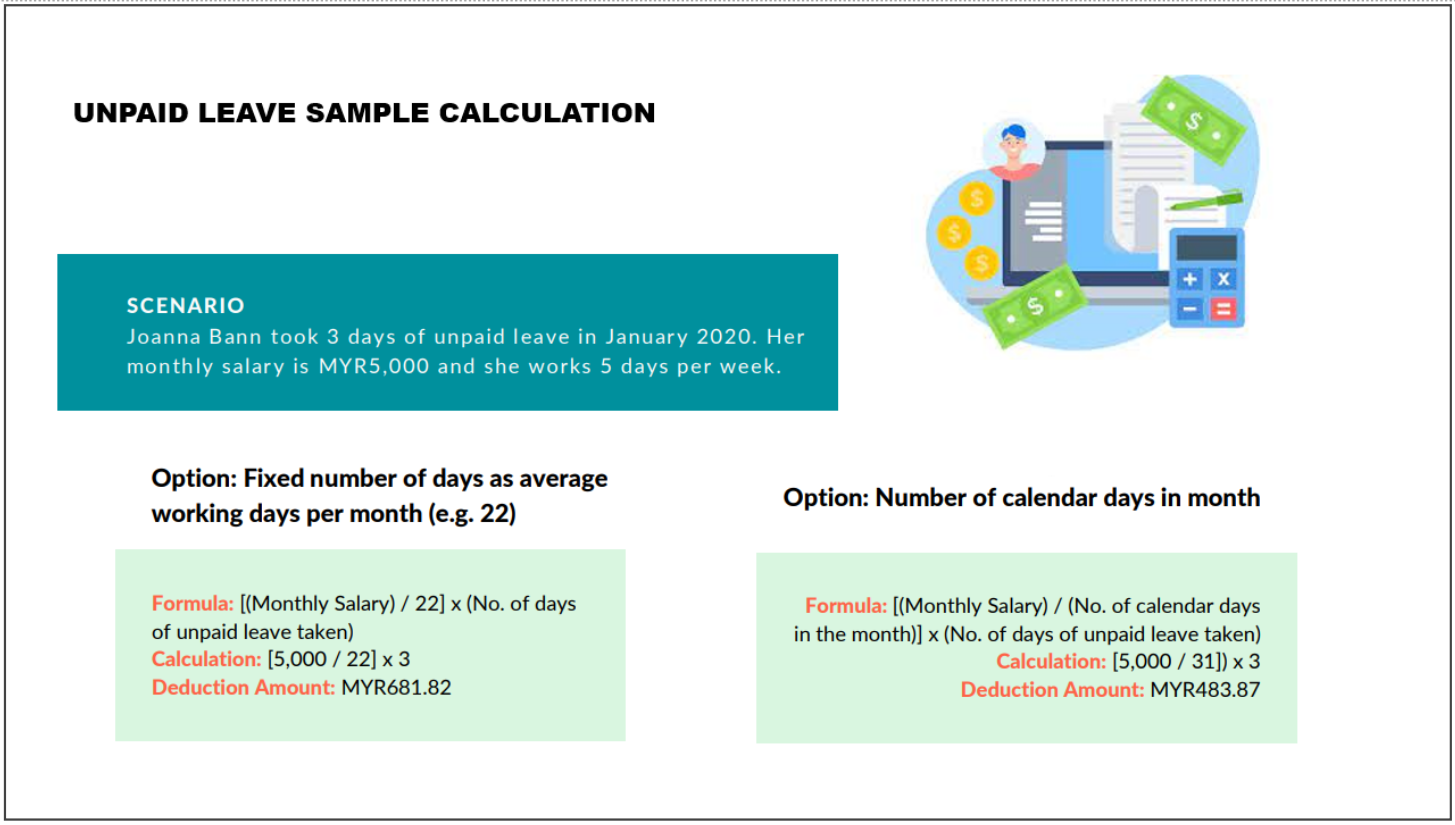

Manual calculation of unpaid leave.

. Of working days worked OPR. Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020. Then multiply by the days that the staff actually worked.

Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators. Sections of this page. Download the table of working days per month for 2021 and 2022.

Exceptionally if the work is of a continuous nature shift work it can be 8 consecutive hours with a paid period of rest not less than 45 minutes 5. Formula calculation salary - commencement of employment incomplete month salary Jump to. How much should be.

Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate. For more details on the minimum wage please read our previous article here. Monthly and daily salary.

A gross pay 22 X working days. At Talenox we believe in designing HR experiences for people not. Under the Minimum Wages Order 2016 effective 1 July 2016 the minimum wage is RM1000 a month Peninsular Malaysia and RM920 a month East Malaysia and Labuan.

What are the required statutory deductions from an employees salary. An employee monthly rate of pay is always fixed to 26. Legal overtime rates are 15 20 and 30 on normal days holidays rest days respectively.

Overtime Based on the Malaysian Employment Act 1955 overtime hours are limited to 104 hours per month. From RM190001 to 200000. Multiply this number by the total days of unpaid leave.

Singapore Prorated Salary Salary for Incomplete Month of Work Calculator. Thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. Salary for January 2016 RM 1000 x 20 31 RM 64516.

Pro-rated salary for an incomplete month Basic salary No. Salary Calculation for Incomplete Month. This calculator which calculates salary for incomplete month of work is catered to employers and employees of all industries including service industries eg.

Review the full instructions for using the Malaysia Salary After Tax Calculators which details. ST Partners PLT Chartered Accountants Malaysia. Actually MOMs formula for incomplete month is regardless of whether they are on shift work or on normal duties.

Take their annual salary and divide it by 52 to get their weekly salary. The result is based on the following formula. Alternatively you send use our very own.

If you are a monthly-rated full-time employee use this calculator to calculate your salary for an incomplete month of work. Example for Working days in Current Calendar Month. Not exceeding an average of 48 hours in a week over any period of 3 weeks.

Pay for an incomplete month of work. Jim earns RM4000 a month and takes 3 days unpaid leave in March 2021. FB retail professional services.

Not salary x work day 30 i give u example u have rm 2000 salary and you worked in oct19 and there is 31 days 8 days weekend and you only work for mon-fri and you have attended all work days. Definitions and calculation for incomplete month of work gross rate of pay and basic rate of pay. To calculate the daily rate you can divide the monthly salary by either of.

Pay for working 23 days in January 2017. Replied by munirah on topic Salary calculation. Number of days in the respective month.

Here we will provide a certain example for EIS Contribution calculation that referring to EIS Contribution table. The salary proration calculation formula can be used in such situations. Paid salary6000- 600030 30-216000-20096000-18004200.

These payroll rates apply to all employees who fall within the definition of the Malaysian. Employee Starts work on 1212016 his salary is RM 1000. Working days in Current Calendar Month including public holidays All Days in Current Calendar Month.

Press alt to open this menu. Salary Formula as follows. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

Now we calculate their salary by dividing 30days. The Overtime Payroll Calculation is used to calculate income based on overtime rates for work performed after normal working hours holidays and weekends. Guidelines for Annual Wage Supplement AWS bonuses and other variable payments.

Calculate pay for incomplete month. The calculator is designed to be used online with mobile desktop and tablet devices. Using your formula 2000x2330 rm 1533.

For example one employee monthly salarywage is 6000-per month and in any month 30days he worked 15days and avail 2 leave with wage and 4 woff then total pay days is 21days. Of working days worked Basic salary 26 x No. This calculator is for months worked in 2021 and 2022.

Now dividing by 26 days. By default in Singapore salary proration is calculated by working days. Using actual work day formula 2000x2323 rm 2000.

Flexi has a salary of RM2000 per month how much does he has to contribute to SOCSO. An employee weekly rate of pay is 6. Salary are paid once a month and must be paid within 7 days after the end of the salary period.

Find the number of working days in the current month. You can determine their daily pay by dividing their weekly pay by the number of days in their working week if the employee. Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month.

Monthly gross rate of pay Total number of working days in that month x Total number of days the employee actually worked in that month. B gross pay 26 X working days. How to Perform Salary Calculator Malaysia.

Of working days in the month x No. If you based on the formula you just need to use their gross salary for the month divided by the total working days in that month inclusive of public holidays. Hi 1how to calculate the salary for an incomplete month for new staff.

MALAYSIA PAYROLL rules and regulations 1. Calculate pay for an incomplete month of work for monthly-rated employees. Monthly gross rate of pay Total number of working days in that month x Total number of days the employee actually worked in that month.

Fixed Number of Days. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. Annual Salary After Tax Calculator.

2what formula to use to calculate monthly salary.

Ijerph Free Full Text The Importance Of An Emotional Expression Guide To Prevent Work Related Health Problems In Emotional Laborers Html

St Partners Plt Chartered Accountants Malaysia Formula Calculation Salary Commencement Of Employment Incomplete Month Salary Facebook

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Salary Individual Income Tax And Social Security In Singapore Asean Business News

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Calculation Of Salary For Incomplete Month Of Work Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Free New Tool Singapore Prorated Salary Calculator

Salary Calculation Dna Hr Capital Sdn Bhd

Compare Incomplete Month To Same Days Of Previous Month In Tableau Interworks

Everything You Need To Know About Running Payroll In Malaysia

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Key Amendments To The Employment Act 1955 Rodl Partner